777qiuqiu.online

Market

How Much In Charitable Contributions Are Tax Deductible

According to the IRS, charitable cash contributions are typically limited to 60% of a taxpayer's adjusted gross income. Are donations worth claiming on taxes? Taxpayers may deduct charitable contributions if they itemize their deductions on Form , Schedule A. The taxpayer must make a voluntary payment and cannot. When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income. Taxpayers must keep records to substantiate cash and noncash charitable contributions. Those who are deducting noncash charitable contributions with a total. You can take a tax deduction for charitable donations made to a qualified organization. You may donate between 1% and 2% of your annual income. How do tax deductions on donations work? Ah, the million-dollar question. When you make a charitable donation, you can deduct the value of your donation from. It can be up to 30 percent of your adjusted gross income. Combine multi-year deductions into one year - Many taxpayers won't qualify for the necessary. However, you should note that there is no tax deduction for a QCD. The bottom line. Each of these donation strategies and vehicles offers different benefits. The charitable deduction is limited to 50% of the taxpayer's Part B income, whether the charitable gifts are cash or otherwise, including appreciated securities. According to the IRS, charitable cash contributions are typically limited to 60% of a taxpayer's adjusted gross income. Are donations worth claiming on taxes? Taxpayers may deduct charitable contributions if they itemize their deductions on Form , Schedule A. The taxpayer must make a voluntary payment and cannot. When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income. Taxpayers must keep records to substantiate cash and noncash charitable contributions. Those who are deducting noncash charitable contributions with a total. You can take a tax deduction for charitable donations made to a qualified organization. You may donate between 1% and 2% of your annual income. How do tax deductions on donations work? Ah, the million-dollar question. When you make a charitable donation, you can deduct the value of your donation from. It can be up to 30 percent of your adjusted gross income. Combine multi-year deductions into one year - Many taxpayers won't qualify for the necessary. However, you should note that there is no tax deduction for a QCD. The bottom line. Each of these donation strategies and vehicles offers different benefits. The charitable deduction is limited to 50% of the taxpayer's Part B income, whether the charitable gifts are cash or otherwise, including appreciated securities.

Deductions for charitable donations generally cannot exceed 60% of your adjusted gross income (AGI), though in some cases, limits of 20%, 30%, or 50% may apply. Charitable contributions to an IRS-qualified (c)(3) public charity can only reduce your tax bill if you choose to itemize your taxes. Generally, you'd. You can only deduct your donation on your federal taxes if the charity has a (c)(3) tax exempt status. Find out by checking the IRS exempt organization. Are charitable donations tax deductible? Yes! In order to take full advantage of the tax benefits, donors must itemize their donations when the combined total. You can take the charity donation tax deduction for your non-cash single charitable donation for one item or a group of similar items is more than $5, if. The aggregate amount of charitable contributions deductible under this section may not exceed 10% of the taxpayer's apportionable income. The limitation imposed. (1) In computing tax under this chapter for a taxable year, a taxpayer may deduct from his or her Washington capital gains the amount donated by the. Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your. (1) In computing tax under this chapter for a taxable year, a taxpayer may deduct from his or her Washington capital gains the amount donated by the. You can deduct your contributions only if you make them to a qualified organization. How to check whether an organization can receive deductible charitable. Then in they take the $29, standard deduction. With this option, the couple has $5, of additional tax deductions over the two years. In addition, if. The charitable deduction for any tax year is limited to a percentage of the taxpayer's contribution base determined by the type of organization receiving the. When all of the individual's contributions during the current year to or for the use of any and all charitable donees are added together, the total income tax. Many nonprofit institutions are exempt from paying federal income tax, but taxpayers may deduct donations to organizations set up under Internal Revenue Code. A corporation may carry forward for five years any qualifying contribution that exceeds the percent ceiling for the tax year of the contribution. Specific. Your deduction for charitable contributions generally can't be more than 60% of your adjusted gross income (AGI), but in some cases 20%, 30%, or 50% limits may. Taxpayers must keep records to substantiate cash and noncash charitable contributions. Those who are deducting noncash charitable contributions with a total. Your charitable donations, including donations made to Unity Parenting and Counseling, are tax deductible. You can deduct charitable contributions made in cash. Deduction over $5, Vehicle donations. Clothing and household items not in good used condition. Qualified appraisal. Qualified appraiser. Easement on. You can deduct charitable contributions from your taxable income—if you follow IRS rules about documenting your gifts.

What To Do When Paid Off Mortgage

Make extra payments · Paying extra each month. When making your payments, add extra money to pay down your balance a little bit at a time. · Making lump sum. Some lenders offer a bimonthly payment schedule, resulting in one extra payment per year, which gets you to your payoff faster with less interest. If your. You'll need to pay property taxes from now on. · Contact your insurance provider. · You must obtain the property deed through your county. Not only did it feel good to pay off a % year fixed mortgage early, but it was also nice to not lose % in the S&P in Paying off my mortgage. After your mortgage is paid off, check with the city/county to ensure there are no liens against the property. Then you should request the title. Amortization is the process of paying off debt with a planned, incremental repayment schedule. An amortization schedule can help you estimate how long you will. But you've got to completely pay off the mortgage to free up cash flow. Otherwise, you're still paying the same mortgage payment amount, it's just the. But I would never advise anyone to pay off their mortgage early without knowing their individual circumstances. Pay off mortgage or invest? Do I have the extra. Property owners do not typically need to take any action once a mortgage has been paid off. Most mortgage lenders will electronically file the form. Make extra payments · Paying extra each month. When making your payments, add extra money to pay down your balance a little bit at a time. · Making lump sum. Some lenders offer a bimonthly payment schedule, resulting in one extra payment per year, which gets you to your payoff faster with less interest. If your. You'll need to pay property taxes from now on. · Contact your insurance provider. · You must obtain the property deed through your county. Not only did it feel good to pay off a % year fixed mortgage early, but it was also nice to not lose % in the S&P in Paying off my mortgage. After your mortgage is paid off, check with the city/county to ensure there are no liens against the property. Then you should request the title. Amortization is the process of paying off debt with a planned, incremental repayment schedule. An amortization schedule can help you estimate how long you will. But you've got to completely pay off the mortgage to free up cash flow. Otherwise, you're still paying the same mortgage payment amount, it's just the. But I would never advise anyone to pay off their mortgage early without knowing their individual circumstances. Pay off mortgage or invest? Do I have the extra. Property owners do not typically need to take any action once a mortgage has been paid off. Most mortgage lenders will electronically file the form.

Once you pay off your mortgage, you will receive documentation from your lender or broker. You will then need to notify your local records office. Refinancing your mortgage is one way to pay off your mortgage and be debt free sooner. You can refinance your mortgage to a shorter term and lower interest. Pay Extra Each Month. Take any leftover funds at the end of the month and make an additional principal payment. · Pay Bi-Weekly · Make an Extra Mortgage Payment. Property Records Search, Inmates, Vehicle Titles, Registrations & Renewals, Financial Transparency, Pay My Taxes, Elections, Fire Restrictions & Bans. Keep your homeowners insurance up. You no longer have an escrow account, so don't forget to pay the taxes each year. What to do after you pay off your mortgage · Celebrating the achievement · Managing your escrow balance and future payments · Updating your insurance provider and. If you want to save on interest: By paying off your mortgage in advance, you can save thousands of dollars in interest. This can be especially impactful if you. Paying off your mortgage early could save you years of interest payments. Investing the money you were going to use to pay off your mortgage early could result. Do you owe for 3 or more mortgage payments due to a financial hardship caused by the pandemic? Do you have a permanent loss of income due to spouse or. A mortgage payoff shows you the total amount you need to pay to settle your mortgage debt, including your interest and other unpaid fees. If you tell your. Pay off your credit cards · Save more money than before · Make saving automatic · Invest in education · Pursue a hobby you've always wanted to try · Don't forget to. Obtain mortgage escrow refund due and plan ahead · Contact your homeowner's insurance company and let them know that you've paid off the mortgage and that bills. Yes, you can pay off your mortgage early if you so choose. You'll do this by putting extra funds toward repaying the principal or the amount you borrowed. When. If you're looking to refinance or pay off your loan balance before the end of the loan term, you'll need to confirm the payoff amount with the servicer. The. For manually underwritten loans, non-medical collection accounts and charge-offs on non-mortgage accounts do not have to be paid off at or prior to closing if. As mentioned in the video, one common strategy for paying down debt is to try to pay more on the one with the highest interest rate first. This may not be your. Use this calculator to determine how many payments it will take to pay off your loan. Loan Information. Current Balance Monthly Payment Interest Rate. Results. Once your mortgage or deed of trust is paid in full, the bank will record a release or deed of reconveyance to release the lien. Sometimes the bank will send. Check whether you need to cancel your repayments. “If your mortgage is with BNZ, we'll automatically stop your repayments once it's all paid off”, says Jay. Congratulations on paying off your mortgage! Once the bank has processed the payoff, they will issue a Discharge of Mortgage. This document needs to be.

Amazon Package Out For Delivery

Most late packages will arrive within 24 to 48 hours of the expected delivery date. If the order has already been shipped, you can't cancel it. Check our. Out for delivery. Sun, Jun 13, , PM PDT, Detroit MI US, Package arrived at a carrier facility. Sun, Jun 13, , PM PDT, Detroit Mi Distribution. “Out for delivery” means that the package has reached the final mail/shipping facility and is en route to your home. You may contact the Courier Partner to talk to the delivery agent or for more information about the location of your package. Go to Your Orders and click on the. The problem is that you expect up to 3 day delivery after an item is ordered. Amazon only says that the package will be delivered next day. The moment your order is ready to ship, Amazon generates an estimated delivery date based on your address and the shipping method you selected. Amazon offers. Out for delivery means that the package has been loaded onto a local delivery vehicle and is en route to recipient address. However, if the tracking status indicates that your package has been delivered, it means the delivery driver has successfully dropped off the package at your. What to do when your package is not delivered, when tracking shows package as delivered but you haven't received it or when you have other delivery issues. Most late packages will arrive within 24 to 48 hours of the expected delivery date. If the order has already been shipped, you can't cancel it. Check our. Out for delivery. Sun, Jun 13, , PM PDT, Detroit MI US, Package arrived at a carrier facility. Sun, Jun 13, , PM PDT, Detroit Mi Distribution. “Out for delivery” means that the package has reached the final mail/shipping facility and is en route to your home. You may contact the Courier Partner to talk to the delivery agent or for more information about the location of your package. Go to Your Orders and click on the. The problem is that you expect up to 3 day delivery after an item is ordered. Amazon only says that the package will be delivered next day. The moment your order is ready to ship, Amazon generates an estimated delivery date based on your address and the shipping method you selected. Amazon offers. Out for delivery means that the package has been loaded onto a local delivery vehicle and is en route to recipient address. However, if the tracking status indicates that your package has been delivered, it means the delivery driver has successfully dropped off the package at your. What to do when your package is not delivered, when tracking shows package as delivered but you haven't received it or when you have other delivery issues.

1 - Confirm shipping address in Your Orders · 2 - Look for a notice of delivery attempt · 3 - Check around the delivery location · 4 - Ask your household members. That doesn't necessarily mean that your package will arrive today, though. UPS Package Out for Delivery but Not Delivered? Here's Why. You should familiarize. Shipping Solutions. Having laid out the issues with business package deliveries and pickups, it's time to outline some of the ways to deal with them. Amazon. According to the deal, it started delivering Amazon packages to Los Angeles When putting a hold on your mail, first have yourself fill out a Hold Mail form. “Out for delivery” means that the package is in the hands of a postal carrier and will be delivered to the recipient on their scheduled delivery date. Out for Delivery: It means that your package has left the seller/ store and is on its way to be delivered to your specified address. Learn how to check the status of your order and find more information about late deliveries or undeliverable orders. What It Means: The package has been prepared for delivery at your local Post Office™ and will be delivered by a carrier today. Not all packages are delivered by. That's when they're using an outside source to deliver their Prime packages. · It means, you can't count on next day delivery. Your parcel is out for delivery. The carrier should be delivering your parcel by the end of the day. Pitney Bowes has received the electronic shipping. We've received the shipment, it's moving through our network and it now has a scheduled delivery date. Shipments can stay in this status until it's out for. It means that the courier has your package and is in the process of delivering it to you. So sit back, relax, and wait for that knock on the door. Your package. However, if the tracking status indicates that your package has been delivered, it means the delivery driver has successfully dropped off the package at your. Hi I was waiting for my package today, I already received my other mails but no OPO. Status says Out for Delivery. USPS come on, Anyone experienced before? This time could be extended on weekends or holidays. If the package has shipped very recently, the tracking page may say “Label Created” and to “Check back. Out for delivery means that your package was scanned by a package handler and it is either ready to be loaded onto a FedEx truck for delivery or is already out. Amazon provides options like two-day or one-day delivery for eligible items. With expedited shipping, customers can receive their packages within a shorter. Some common conditions for non-delivery include: The package is out on the street for delivery. The credit or debit card is no longer valid. The post office was. When the package is on its way, the customer gets notified and packages are delivered to the customer's front door or another package pickup point, such as an. Learn how to check the status of your order and find more information about late deliveries or undeliverable orders.

Percentage Down To Avoid Pmi

How to Avoid Paying PMI · Make a down payment of 20% or more. · Apply for a VA loan (if eligible). A VA loan however only avoids the monthly mortgage insurance. Annual mortgage insurance for FHA borrowers ranges from to percent depending on loan balance and term - though most FHA borrowers pay percent of. With the options discussed above, home buyers can purchase a home they like with 10% down and still avoid paying PMI. Just be sure to run those numbers. PMI fees vary depending on the size of the down payment and the size of the loan. They typically range between % and 1% of the original loan amount per year. However, for loans originated after this date, MIP typically remains for the life of the loan unless you put down more than 10 percent initially. In that case. PMI fees vary depending on the size of the down payment and the size of the loan. They typically range between % and 1% of the original loan amount per year. One strategy to avoid PMI involves getting an 80/10/10 loan where you put 10% down and take out a 10% home equity line of credit and use that to satisfy the 20%. A word of warning: PMI does not offer borrowers any protection. If you fall behind on your PMI payments, you could lose your home to foreclosure. Avoiding PMI. The best way to avoid PMI is to save up your money until you can put 20 percent down on the house. PMI is not required if you pay the 20 percent down. How to Avoid Paying PMI · Make a down payment of 20% or more. · Apply for a VA loan (if eligible). A VA loan however only avoids the monthly mortgage insurance. Annual mortgage insurance for FHA borrowers ranges from to percent depending on loan balance and term - though most FHA borrowers pay percent of. With the options discussed above, home buyers can purchase a home they like with 10% down and still avoid paying PMI. Just be sure to run those numbers. PMI fees vary depending on the size of the down payment and the size of the loan. They typically range between % and 1% of the original loan amount per year. However, for loans originated after this date, MIP typically remains for the life of the loan unless you put down more than 10 percent initially. In that case. PMI fees vary depending on the size of the down payment and the size of the loan. They typically range between % and 1% of the original loan amount per year. One strategy to avoid PMI involves getting an 80/10/10 loan where you put 10% down and take out a 10% home equity line of credit and use that to satisfy the 20%. A word of warning: PMI does not offer borrowers any protection. If you fall behind on your PMI payments, you could lose your home to foreclosure. Avoiding PMI. The best way to avoid PMI is to save up your money until you can put 20 percent down on the house. PMI is not required if you pay the 20 percent down.

Not all conventional loans require PMI even if you have a down payment of less than 20%. These mortgages will require you to pay a higher interest rate. Once you pay the loan balance down to 80% of the original value, you can request to remove PMI. Adding additional principal payments over time will reduce the. Conventional loans · 20% down payment: Make a 20% down payment and, in most cases, you can avoid PMI altogether. · Borrower-paid PMI: · Pay PMI upfront: · Lender-. Typically, you'll need PMI if you put down less than 20% of the home's purchase price. Programs, rates, terms and conditions are subject to change without. According to lending rules, you need a 20% down payment to avoid PMI. With this structure you finance half your 20% down payment. It sounds strange that the. There are a couple of ways to avoid paying PMI if you don't have 20 percent saved for a down payment. One is to search for loan programs that have smaller down. In order to avoid having to add PMI (private mortgage insurance) to a loan you need to pay a down payment of at least 20% or more. Actually you. Our loan programs offer the flexibility of low down payments ranging from 1% to 5% without requiring PMI.. Competitive Interest Rates. Our no PMI program it. PMI (private mortgage insurance) is required when borrowers put less than 20 percent down on a home. This insurance protects the lender if borrowers default on. In order to avoid having to add PMI (private mortgage insurance) to a loan you need to pay a down payment of at least 20% or more. Actually you. Three options exist for buyers who want to avoid PMI premiums but still put down less than 20%: compel the lender to pay: In exchange for a higher interest rate. Down payments & PMI. Typically, buyers put down 5 to 20% of the purchase price but this can be as little as 3%. Buyers putting down less than. Hunt for lender-paid mortgage insurance or a piggyback loan, or seek gifts or other assistance to fatten the down payment. SoFi offers fixed-rate conventional. How to Avoid PMI. The most commonly known way to avoid private mortgage insurance is to make a down payment of 20%. However, as home values have continually. PMI is an added insurance policy for homeowners who put less than a 20% down payment and is designed to protect the lender if you are unable to pay your. How to avoid PMI with a no-PMI mortgage · A bigger down 777qiuqiu.online you want a mortgage without PMI, you'll need to make a down payment of at least 20%. Share: · Make the full 20 percent down payment. The higher the down payment, the better. · Talk to your lender about loan programs that do not require PMI and see. PMI allows buyers to put down less than 20% for a down payment Going with this option will also lower the percentage required of the down payment. Bye-Bye PMI is a year fixed-rate mortgage that allows a borrower to make a down payment of only 15% without paying monthly PMI.

Top Bullion Dealers

Want to invest in precious metals? New York Gold Co offers a wide range of gold, silver, platinum, and palladium bars and coins at the best prices. Buy Gold Bullion. Hatton Garden Metal is one of the UK's Top Rated Gold Bullion Dealers, renown for its credibility and reliability in providing gold. Buy Silver and Gold from SilverTowne. Precious Metal Prices updated real-time. Best place to buy silver since Free Shipping on orders $99+. Online Coin Dealers · Waretown Stamp & Coin Shop - Buying and selling precious metals for over 50 years. · Seaport Coins - Leading numismatic retailer for Leading dealer of investment-quality gold bars and gold coins from the U.S. Mint and other suppliers on our website. Get free shipping & portfolio advice. Customers all across the country have quickly come to recognize BGASC as one of the largest, fastest, most trusted online precious metals dealers in the 777qiuqiu.online American Hartford Gold - Best place to buy gold and silver online overall; Priority Gold - Best for personalized gold investment solutions; GoldCo - Best for. Muzeum Gold & Silver. Toronto's top paying gold and silver buyer. See their live prices today. Prices increase with volume! VIEW OUR LIVE BUYING PRICES. Buy Gold, Silver, Platinum & Palladium Bullion online at 777qiuqiu.online Find rare numismatic coins & currency with fast, free shipping on orders +$ Want to invest in precious metals? New York Gold Co offers a wide range of gold, silver, platinum, and palladium bars and coins at the best prices. Buy Gold Bullion. Hatton Garden Metal is one of the UK's Top Rated Gold Bullion Dealers, renown for its credibility and reliability in providing gold. Buy Silver and Gold from SilverTowne. Precious Metal Prices updated real-time. Best place to buy silver since Free Shipping on orders $99+. Online Coin Dealers · Waretown Stamp & Coin Shop - Buying and selling precious metals for over 50 years. · Seaport Coins - Leading numismatic retailer for Leading dealer of investment-quality gold bars and gold coins from the U.S. Mint and other suppliers on our website. Get free shipping & portfolio advice. Customers all across the country have quickly come to recognize BGASC as one of the largest, fastest, most trusted online precious metals dealers in the 777qiuqiu.online American Hartford Gold - Best place to buy gold and silver online overall; Priority Gold - Best for personalized gold investment solutions; GoldCo - Best for. Muzeum Gold & Silver. Toronto's top paying gold and silver buyer. See their live prices today. Prices increase with volume! VIEW OUR LIVE BUYING PRICES. Buy Gold, Silver, Platinum & Palladium Bullion online at 777qiuqiu.online Find rare numismatic coins & currency with fast, free shipping on orders +$

How To Ship Your Bullion Best? Congratulations! Buying Gold & Silver from Online Dealers. Years ago, collectors and investors. We've compiled a list of the best online precious metal dealers, so you can make an informed decision and get the best deal. This nationally renowned coin dealer, serving California coin collectors for more than four decades, is one of the best-known coin shops in the country. They. The Top Gold Dealer in Westmont, IL Americash Jewelry & Coin Buyers Inc. is your premier gold buyer in the Chicago area. We service customers throughout the. Best Online Gold Dealers for September · Best Overall: APMEX (American Precious Metals Exchange) · Best Customer Experience: JM Bullion · Best for Gold. Provident Metals is a leading online retailer of international and Known as the People's Bullion Dealer, Provident was founded at the request. Buy Gold, Silver, Platinum, and Palladium Bullion from through a network of official distributors or Authorized Purchasers and dealers. United States Mint. JM Bullion is one of America's leading online bullion retailers. They offer a variety of gold, silver, copper, and platinum products at highly competitive. GoldSilver offers a selection of gold and silver bars and coins from sovereign mints and leading precious metals refineries. Click here to visit 777qiuqiu.online PPM, a leading Precious Metals dealer in the United States, understands the needs of Gold and Silver investors. Now surpassing 11 years in business. Wholesale Coins Direct offers rare coins, platinum, silver coins, and gold bullion direct to precious metals dealers and the public on our online website. Buy Gold, Silver & Platinum Bullion Coins and bars online at the trusted leader in precious metals. Fast, free secure shipping with the lowest prices. Rare Coin & Bullion Dealer in Austin Austin Rare Coins & Bullion has been an industry leader in physical precious metals & rare coins since We'. Rare Coin & Bullion Dealer in Austin Austin Rare Coins & Bullion has been an industry leader in physical precious metals & rare coins since We'. Bullion Exchanges is thrilled to announce the launch of our comprehensive US Local Bullion Dealer Directory. This new resource is specifically designed to. Finding the best online gold dealer among dozens can be daunting. After reviewing the best online gold dealers, we determined that APMEX is the best. Showing: 3, results for Precious Metal Dealers near USA ; Wine Country Coin Gold & Silver. Precious Metal Dealers, Coin Dealers, Estate Liquidators · (). American Bullion · 777qiuqiu.online · DBS Coins · Goldco · Goldline, LLC · LCR Coin, Inc. · Pacific Precious Metals · Pacific Precious Metals. Buy Physical Gold & Silver Bullion At PIMBEX. We Have A Great Selection & Excellent Prices On All Of Our In Stock Bullion. Top 10 Best Gold Coin Dealers in New York, NY - August - Yelp - Global Gold & Silver, Big Apple Coins, American Coin & Stamp Co Inc, Bullion Trading.

What Is The Tax Rate On Long Term Capital Gains

"Net long-term capital gains" means net long-term capital gains as that term is defined in section of the Internal Revenue Code, 26 USC In Canada, the capital gain inclusion rate is 50%, which means when a capital asset is sold for more than it was paid for, the CRA applies a tax on half (50%). These tax rates and brackets are the same as those applied to ordinary income, like your wages, and currently range from 10% to 37% depending on your income. long-term capital gain subject to Washington's capital gains tax. Is day You will enter the total amount of long-term gains in the Proceeds (sale. The maximum capital gains tax rate for individuals and corporations · – · % · %. Long-term capital gains, on dispositions of assets held for more than one year, are taxed at a lower rate. The Washington State Legislature recently passed ESSB (RCW ) which creates a 7% tax on the sale or exchange of long-term capital assets such as. The taxable part of a gain from selling Internal Revenue Code Section qualified small business stock is taxed at a maximum 28% rate. Specifically, for. Long-term capital gains taxes occur when an asset has been sold after being owned for over a year. These taxes can have rates of 0%, 15% or 20% depending on. "Net long-term capital gains" means net long-term capital gains as that term is defined in section of the Internal Revenue Code, 26 USC In Canada, the capital gain inclusion rate is 50%, which means when a capital asset is sold for more than it was paid for, the CRA applies a tax on half (50%). These tax rates and brackets are the same as those applied to ordinary income, like your wages, and currently range from 10% to 37% depending on your income. long-term capital gain subject to Washington's capital gains tax. Is day You will enter the total amount of long-term gains in the Proceeds (sale. The maximum capital gains tax rate for individuals and corporations · – · % · %. Long-term capital gains, on dispositions of assets held for more than one year, are taxed at a lower rate. The Washington State Legislature recently passed ESSB (RCW ) which creates a 7% tax on the sale or exchange of long-term capital assets such as. The taxable part of a gain from selling Internal Revenue Code Section qualified small business stock is taxed at a maximum 28% rate. Specifically, for. Long-term capital gains taxes occur when an asset has been sold after being owned for over a year. These taxes can have rates of 0%, 15% or 20% depending on.

State Capital Gains Tax Rates ; 3, Washington D.C., % ; 5, Oregon *, % ; 6, Minnesota, % ; 7, Massachusetts, %. While the federal long-term capital gains tax applies to all states, there are eight states that do not assess a long-term capital gains tax. They are Alaska. Arizona taxes capital gains as income, and both are taxed at the same rate of %. Arkansas. In Arkansas, 50% of long-term capital gains are treated as income. STCGs are taxed as ordinary income, as are mutual fund distributions of dividends and interest, and this ordinary income tax rate is higher than an investor's. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. The Percentage Exclusion for capital gains is capped at $, This means that any gain above $, will be taxed at standard income tax rates. The Flat. How does the federal government tax capital gains income? Four maximum federal income tax rates apply to most types of net long-term capital gains income in tax. Capital gains are subject to the standard CIT rate of 18%. Taxable as ordinary income. United Arab Emirates (Last reviewed 24 July ), Same as UAE CT rates. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. Long-term capital gains generally qualify for a tax rate of 0%, 15%, or 20%. Under the Tax Cuts and Jobs Act of , long-term capital gains tax rates are. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. Short-Term Capital Gains Tax Rates Short-term capital gains are taxed as ordinary income. Any income that you receive from investments that you held for one. Short-term capital gains are taxed as ordinary income at rates up to 37 percent; long-term gains are taxed at lower rates, up to 20 percent. Taxpayers with. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double. They're usually taxed at lower long-term capital gains tax rates (0%, 15%, or 20%). Capital gains from stock sales are usually shown on the B. Short-Term Capital Gains Taxes for Tax Year (Due April ) ; Single Filers · $0 - $11, · $11, - $47, · $,+ ; Married, Filing Jointly · $0 -. Short-term capital gains (for assets held for less than a year) are typically taxed at your ordinary income tax rate, which can range from 10% to 28%. Table 4. Revenue Effects of President Biden's FY Budget ; Tax unrealized capital gains at death over $5 million and impose a % tax rate on capital gains. Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing. If you owned the asset for more than a year, the gain is considered long-term, and special tax rates apply. The current capital gains tax rates are.

Cricut Joy Black Friday

Current Cricut Joy Bundle Deals. 1. Cricut Joy Essentials Bundle. 2. Cricut Joy Cheap Cricut Maker Deals. Cricut Maker Black Friday Deals. Black Friday Machine Deals. Ricoma is having their Black November Sale! Good Cricut Joy Machine · Cricut Maker 3 · Cricut Explore 3 · Cricut Explore Air 2. Here is a list of all the Cricut Joy Black Friday deals. >>> Grab it for $ from Cricut with Access Membership discounts. 777qiuqiu.online has the the Joy. Hurry! $ $ Walmart Black Friday: Cricut Explore Air 2 Emerald Cricut Explore Air 2 Bundle Cutting Machine with Cricut Joy $ Black Friday is an awesome time to shop for great deals on crafty Cricut Joy Machine –. Paul Rubens Artist Watercolor Paints-Metallic Glitter. M posts. Discover videos related to Cricut Joy Black Friday Deals on TikTok. See more videos about Cricut Explore Black Friday Deals, Cricut Joy. Cricut Black Friday FAQs. Cricut home die-cutting machines are perfect for first-time crafters or true DIY connoisseurs. The Cricut machines look like a. Or fastest delivery Friday, August Order within 1 hr 28 mins Cricut Smart Permanent Vinyl (in x 48in, Black) for Joy machine - matless. It's $ with free shipping after the email savings coupon. The Joy is on sale for $ when you use your coupon and save $10 off $ (Regular price is. Current Cricut Joy Bundle Deals. 1. Cricut Joy Essentials Bundle. 2. Cricut Joy Cheap Cricut Maker Deals. Cricut Maker Black Friday Deals. Black Friday Machine Deals. Ricoma is having their Black November Sale! Good Cricut Joy Machine · Cricut Maker 3 · Cricut Explore 3 · Cricut Explore Air 2. Here is a list of all the Cricut Joy Black Friday deals. >>> Grab it for $ from Cricut with Access Membership discounts. 777qiuqiu.online has the the Joy. Hurry! $ $ Walmart Black Friday: Cricut Explore Air 2 Emerald Cricut Explore Air 2 Bundle Cutting Machine with Cricut Joy $ Black Friday is an awesome time to shop for great deals on crafty Cricut Joy Machine –. Paul Rubens Artist Watercolor Paints-Metallic Glitter. M posts. Discover videos related to Cricut Joy Black Friday Deals on TikTok. See more videos about Cricut Explore Black Friday Deals, Cricut Joy. Cricut Black Friday FAQs. Cricut home die-cutting machines are perfect for first-time crafters or true DIY connoisseurs. The Cricut machines look like a. Or fastest delivery Friday, August Order within 1 hr 28 mins Cricut Smart Permanent Vinyl (in x 48in, Black) for Joy machine - matless. It's $ with free shipping after the email savings coupon. The Joy is on sale for $ when you use your coupon and save $10 off $ (Regular price is.

Cricut Joy Xtra™ Smart Cutting Machine + Starter Kit - White. Model Cricut - Premium Removable Vinyl - Black - Front_Zoom · Rating. Cricut Joy Machine & Digital Content Library Bundle – Includes 30 images in Design Space App at Amazon – $ Cricut Joy at Walmart – $ (same deal at. BLACK ADAM, THE DARK KNIGHT RISES, THE DARK KNIGHT, DC LEAGUE OF SUPER-PETS (sXX); FRIDAY THE 13TH, FREDDY VS. JASON, and all related characters. How To Make A T-Shirt With Cricut Joy + FREE Prayer Warrior SVG Black Friday T-shirts with Cricut Maker + Cut Files. Kim Byers · Does Cricut tend to put machines on sale for Black Friday/after Christmas? The Maker + everything bundle is currently on sale such that. Cricut Joy Glitter Gel Pens, mm in Black, Gold, Silver; Cricut Joy Xtra (sXX); FRIDAY THE 13TH, FREDDY VS. JASON, and all related characters and. 2. Cricut Joy. Cricut Joy is a compact machine that provides great options to craft. If paper crafting is your passion, this is the best machine. Hey! I am Leilani, a passionate freelance crafter who finds joy in creating unique home decor. The journey from beginner to pro-level DIYer has. Shop Cricut Joy Cutting and Writing Machine at Target. Choose from Same Day Delivery, Drive Up or Order Pickup. Free standard shipping with $35 orders. This Black Friday at Craftelier we have amazing discounts on Circut Joy, Maker 3, Explore, Easy Press range and Accessories. Cricut Joy Xtra™ Smart Cutting Machine + Starter Kit - White. Model Cricut - Premium Removable Vinyl - Black - Front_Zoom · Rating. Cricut machine & bundle deals for Black Friday , featuring the top savings on the Explore Air 2, Explore 3, Joy Xtra, Everything Bundle & more. Access. Cricut Maker is among the most cutting-edge and versatile cutting machines available in the market. This machine is an excellent choice for. Black Friday Alert! WIN a Cricut Joy for you and your Bestie this Black Friday! Tell us what you will create if you WIN a Cricut Joy. Black Friday Alert! WIN a Cricut Joy for you and your Bestie this Black Friday! Tell us what you will create if you WIN a Cricut Joy, tag your best. Teachers get an additional 15% off Cricut materials and accessories plus special discounts on Cricut Maker® 3 and Cricut Joy Xtra™. USA: Monday–Friday: 9 am. accessoriesCricut Explore Air 2 WALMART Bundle $ – includes: Essential Tool Kit and 20 Piece Premium Vinyl Set Cricut Joy Black Friday Deals 777qiuqiu.online Current Cricut Joy Bundle Deals. 1. Cricut Joy Essentials Bundle. 2. Cricut Joy Cheap Cricut Maker Deals. Cricut Maker Black Friday Deals. Save up to 60% on Cricut cutting machines, heat presses, and crafting bundles during Cricut's Black Friday Sale. Cricut Explore, Cricut Joy, Cricut EasyPress.

What I Need To Open A Bank Account Chase

You'll need to provide official, government-issued photo identification. Many of these requirements may be familiar to U.S. citizens as well. Some financial. If you are an adult with the legally required ID such as a passport or driver's license, and a social security card, it is the same as any other. Opening a business bank account requires proof of identification for both you and your business. Examples include your state-issued driver's license or passport. want to apply in person. You'll need to open both accounts at the same time—not staggered. Receive a direct deposit into the Chase Total Checking® account. What do I need to open a checking account? · Identification. · Proof of address. It must show your name and address of your residence. · Opening deposit. You may. *For new Rewards Savings accounts Bank of America will waive the monthly fee for the first 6 months from the account's opening. Required Opening Deposit of $ Information required to open business banking account: · Personal Identification: · Tax Identification Number: · Business Documentation: · Assumed Name Certificate. Debit cards are often provided when you open an account at a bank, credit union, or financial institution. There might be some cases in which to get a debit. When will your new debit card arrive? How can you activate your new card? Find the answers to your new savings and checking account questions in one place. You'll need to provide official, government-issued photo identification. Many of these requirements may be familiar to U.S. citizens as well. Some financial. If you are an adult with the legally required ID such as a passport or driver's license, and a social security card, it is the same as any other. Opening a business bank account requires proof of identification for both you and your business. Examples include your state-issued driver's license or passport. want to apply in person. You'll need to open both accounts at the same time—not staggered. Receive a direct deposit into the Chase Total Checking® account. What do I need to open a checking account? · Identification. · Proof of address. It must show your name and address of your residence. · Opening deposit. You may. *For new Rewards Savings accounts Bank of America will waive the monthly fee for the first 6 months from the account's opening. Required Opening Deposit of $ Information required to open business banking account: · Personal Identification: · Tax Identification Number: · Business Documentation: · Assumed Name Certificate. Debit cards are often provided when you open an account at a bank, credit union, or financial institution. There might be some cases in which to get a debit. When will your new debit card arrive? How can you activate your new card? Find the answers to your new savings and checking account questions in one place.

Bank with Chase and you can open a Chase saver account. It gives you To bank with Chase, you'll need to: be 18+; be a resident of the UK only. To open an individual or joint checking account, each potential account holder will need a government-issued photo ID. The checking account application requires. Checking account fees Chase Total Checking · Electronic deposits made into this account totaling $ or more. · Daily balance of $1, or more in just this. Identification: · Passport w/photo · Driver's License Or State ID w/photo (U.S.) · Social Security Card · Birth Certificate (minors only). For Chase. You'll likely need a government-issued photo ID (such as a driver's license or passport) and proof of address. Some banks require your Social Security or. An average beginning day balance of $15, or more in qualifying Chase accounts · A linked qualifying Chase first mortgage enrolled in automatic payments · For. If you used First Republic online banking and are new to JPMorgan Chase: Set up your account at 777qiuqiu.online You will need your Social Security. You'll need two forms of identification, and one of them must be a primary government-issued ID. If a person with power of attorney is opening the account, they. Monthly maintenance fee. $0. You must be an existing Chase checking customer to open the account for your kids ages 6 to · Minimum deposit to open. $0. No minimum deposit requirements: Some savings accounts require you to make a minimum deposit when you open your account, but neither the Chase Savings nor the. Account details include: · A balance at the beginning of each day of $ or more in this account · OR $25 or more in total Autosave or other repeating automatic. Social Security number · A valid driver's license or other government-issued photo ID · Some accounts require an initial deposit, so you'll need. I set up the direct deposit with my employer. All that was needed was the routing number and account number. My account was setup for paperless. Open a new Chase Savings account, deposit at least $15, of new money into the account within 30 days of coupon enrollment and maintain a balance of at least. I set up the direct deposit with my employer. All that was needed was the routing number and account number. My account was setup for paperless. Personal identification documents — As the business owner, you will need to supply the bank with a form of government-issued identification, such as a driver's. So how do you open an account? · Government issued photo ID or driver's license · Social Security Card or Individual Taxpayer Identification Number · Passport. Find out what you'll need to open a business checking account · Sole Proprietorship checklist · Partnerships checklist · Limited Liability Company LLC checklist. Grow the way you want with Chase Merchant Services. Let our experts Chase and the Octagon logo are registered trademarks of JPMorgan Chase Bank, N.A. Understand common requirements and fees · Know the types of accounts · Gather the appropriate documents · Make a deposit and put your account to use · Get started.

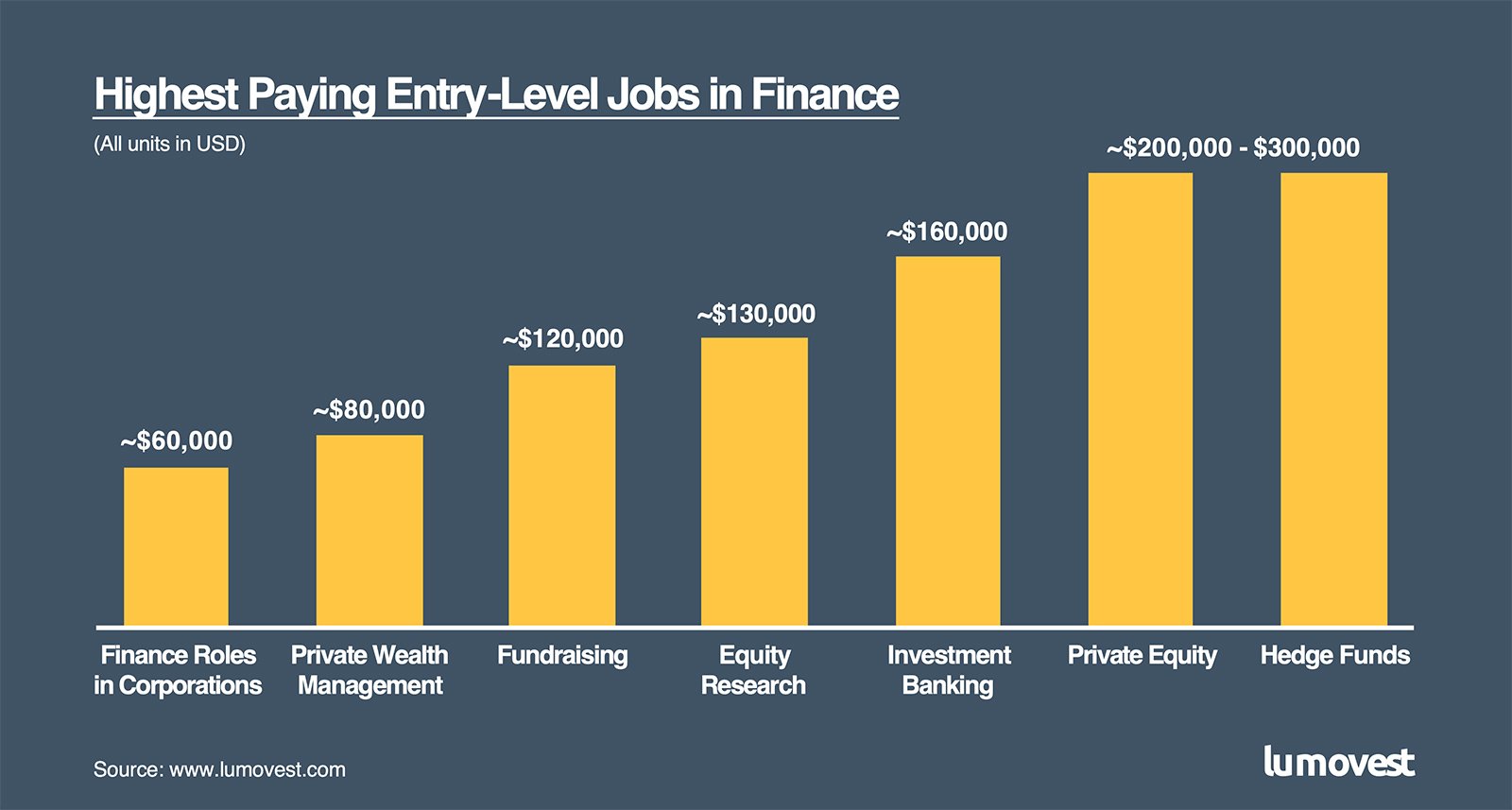

Good Entry Level Finance Jobs

96 Best Entry Level Finance Jobs in Atlanta Metropolitan Area (8 new) · Entry Level Management Associate · Document Management Analyst I · Document Management. A popular entry-level role to consider in finance is the job of financial analyst. This is a sought-after position because these roles are pivotal in many. 10 Best Entry-Level Finance Jobs & How Much They Pay · 1. Actuary · 2. Financial Analyst · 3. Personal Financial Advisor · 4. Budget Analyst · 5. Credit Analyst. Top Entry Level Finance Jobs in Sacramento, CA ; Analyst, Operational Accounting. 22 Hours Ago. United States ; Accounts Payable Supervisor. Yesterday. United. Richa, the entry level job/ compay should be one which has a core finance work or finance related work. Every organisation has its own finance. Richa, the entry level job/ compay should be one which has a core finance work or finance related work. Every organisation has its own finance. Entry Level Finance jobs available on 777qiuqiu.online Apply to Entry Level Financial Analyst, Broker, Controller and more! Northern Trust offers entry level finance and accounting opportunities across a variety of departments including Corporate Finance and Audit as well as our. Jobs like Financial Analyst, Junior Tax Associate, Financial Auditor, Investment Banking Analyst, Financial Advisor, and Stockbroker are entr-level positions. 96 Best Entry Level Finance Jobs in Atlanta Metropolitan Area (8 new) · Entry Level Management Associate · Document Management Analyst I · Document Management. A popular entry-level role to consider in finance is the job of financial analyst. This is a sought-after position because these roles are pivotal in many. 10 Best Entry-Level Finance Jobs & How Much They Pay · 1. Actuary · 2. Financial Analyst · 3. Personal Financial Advisor · 4. Budget Analyst · 5. Credit Analyst. Top Entry Level Finance Jobs in Sacramento, CA ; Analyst, Operational Accounting. 22 Hours Ago. United States ; Accounts Payable Supervisor. Yesterday. United. Richa, the entry level job/ compay should be one which has a core finance work or finance related work. Every organisation has its own finance. Richa, the entry level job/ compay should be one which has a core finance work or finance related work. Every organisation has its own finance. Entry Level Finance jobs available on 777qiuqiu.online Apply to Entry Level Financial Analyst, Broker, Controller and more! Northern Trust offers entry level finance and accounting opportunities across a variety of departments including Corporate Finance and Audit as well as our. Jobs like Financial Analyst, Junior Tax Associate, Financial Auditor, Investment Banking Analyst, Financial Advisor, and Stockbroker are entr-level positions.

Entry Level Finance Jobs in Boston, MA · Vaco, LLC · Vaco, LLC · SynergisticIT · Jobot · Kforce Inc. · Kforce Inc. · Vaco, LLC · Liberty Mutual. $ 10 Top Entry-Level Finance Jobs · 1. Accounts Payable Jobs · 2. Accounts Receivable Jobs · 3. Audit Associate Jobs · 4. Billing Specialist Jobs · 5. Budget Analyst. 8 highest paying entry-level finance jobs · 1. Financial manager · 2. Personal finance advisor · 3. Management analyst · 4. Financial analyst · 5. Financial examiner. Agents provide financial knowledge, education, and strategies for business matters, insurance protection, retirement, savings and estate planning. 21,+ Entry Level Finance Jobs in United States ( new) · Assistant Merchandise Planner · Asset Management Analyst · Junior Financial Analyst - Private. Entry Level Finance Jobs in Fort Collins, CO · Vector Marketing · UniFirst · Jobot · Jobot · GFI Pros · Felsburg Holt & Ullevig · Luma Marketing Group. Entry level finance jobs in California ; Confidential. Controller. Fresno, CA. $97K (Employer est.) Easy Apply ; Financial Advisors Network, Inc. Paraplanner. Entry level finance jobs in New York, NY · Accountant - Entry Level · Entry Level - Experienced Teacher · On Premise - Entry Level Sales Representative · Entry. Top Entry Level Finance Jobs in Philadelphia, PA · Drexel ETP - Fall/Winter · Complex Claims Consultant - Financial Lines/Public D&O · Care Tax Expert -. Jobs like Financial Analyst, Junior Tax Associate, Financial Auditor, Investment Banking Analyst, Financial Advisor, and Stockbroker are entr-level positions. Looking for an entry level job in finance? Discover the best jobs for finance majors in this guide. Finance is a practical field that will always be in demand. Search the best Entry Level Finance Jobs from top companies & startups in Chicago, IL. New jobs added daily. Entry-level financial analysts play a critical role in businesses, since they take charge of sorting out budget and income statement projections into reports. Entry-level jobs in finance with high compensation [] · 1. Financial Analyst · 2. Accountant · 3. Actuary · 4. Personal finance advisor · 5. Credit Analyst · 6. entry level finance jobs in florida · Investment Advisor/ Specialist Role - Florida · Associate Advisor - Satellite Beach, FL · Finance Administrative Assistant. A Look at Entry-Level Careers in Finance · Working in Financial Services · Accounting · Investment Banking · Operations · FinTech · Compliance · The Bottom Line. Financial firms, as well as large companies, often hire many financial analysts. And working as a financial analyst can be a good entry-level finance job for. 7, Entry level finance jobs in United States Bell Textron Inc. $49K - $92K (Glassdoor est.) A Bachelor's degree or higher with a major in Finance. Finance Jobs · Filtered by · Principal Associate - Client Development · Senior Associate - Client Development · Principal Associate, Accounting · Area Sales Manager.

Best Stock Trade Sites

Discount brokers are a user-friendly and cost-effective platform where the brokerage service mainly focuses on basic trading. They are primarily for simple. E*TRADE: Invest. Trade. Save. 4+. Stocks, options, mutual funds. E*TRADE Securities. Designed for iPad. E*TRADE from Morgan Stanley offers $0 commissions for online US-listed stock, ETF, mutual fund, and options trades - other rates and fees may apply. Discount Brokerage Trading · PAY ONLY WHEN YOU PROFIT · ZERO Delivery Brokerage · Pay only when you profit · Platforms tested by trading enthusiasts · Platforms. The best online brokers for stocks in September · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers · Merrill Edge · Ally Invest. Powerful trading platforms, valuable stock market research, trading ideas, exceptional customer service. Open an account now. Research and compare the best online stock trading brokers. Benzinga rated the top stock trading brokers. Find out who made the cut. That means traders at Schwab now get the best in trading—award-winning platforms, tailored education, and specialized support—all from one of the most trusted. Tell me what is, in your opinion, the best trading platform and why. Yes I know some regards are so terminally regarded they will regard out and whine instead. Discount brokers are a user-friendly and cost-effective platform where the brokerage service mainly focuses on basic trading. They are primarily for simple. E*TRADE: Invest. Trade. Save. 4+. Stocks, options, mutual funds. E*TRADE Securities. Designed for iPad. E*TRADE from Morgan Stanley offers $0 commissions for online US-listed stock, ETF, mutual fund, and options trades - other rates and fees may apply. Discount Brokerage Trading · PAY ONLY WHEN YOU PROFIT · ZERO Delivery Brokerage · Pay only when you profit · Platforms tested by trading enthusiasts · Platforms. The best online brokers for stocks in September · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers · Merrill Edge · Ally Invest. Powerful trading platforms, valuable stock market research, trading ideas, exceptional customer service. Open an account now. Research and compare the best online stock trading brokers. Benzinga rated the top stock trading brokers. Find out who made the cut. That means traders at Schwab now get the best in trading—award-winning platforms, tailored education, and specialized support—all from one of the most trusted. Tell me what is, in your opinion, the best trading platform and why. Yes I know some regards are so terminally regarded they will regard out and whine instead.

TD Ameritrade and E*TRADE do not offer fractional share trading. All data are sourced from public websites as of July 28, and subject to change. Get. Merrill Edge brings strong research and education to the investing space, offering a solid trading platform for stocks, bonds, options and funds. You'll likely. Brokers buy and sell stocks through an exchange, charging a commission to do so. A broker is simply a person who is licensed to trade stocks through the. Electronic trading platforms typically stream live market prices on which users can trade and may provide additional trading tools, such as charting packages. Looking to harness the power of options leverage? Here are the best options trading platforms based on tools, ease of use, pricing, probability calculators. Best Overall: Fidelity · Best for Low Costs: Fidelity · Best for Beginners: Charles Schwab · Best for Advanced Traders: Interactive Brokers · Best for ETFs. Firstrade Securities offers investment products and tools to help you take control of your financial future. Experience commission-free trading with us. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Which Platforms are Right for You? · IBKR Desktop · Trader Workstation (TWS) · IBKR Mobile · IBKR GlobalTrader · Client Portal · IBKR APIs · IBKR ForecastTrader. Online stock trading and investing platform for Stocks, F&O, Commodity, ETFs, Mutual Funds and IPO - Start online trading in stock market with Dhan! 777qiuqiu.online has carefully researched the top stock brokers, comparing everything from head to toe. Read our expert reviews to find the right broker for you. Best Online Brokers in · Our Top Brokers · Charles Schwab · Fidelity · Interactive Brokers · Ally Invest · E-Trade · Merrill Edge · Robinhood. Lightspeed Trader is our flagship trading platform. It is a best investing experience on our websites. Adjust cookie settings. Stay up-to. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. E*Trade and TD Ameritrade offer the most educational tools and have access to the most investment asset options. Both of these companies also have robust mobile. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Find top products in Online Trading Platforms category. Software used to electronically trade stocks, bonds, and commodities on one platform. TradeStation offers a full suite of advanced trading technology, online brokerage services, & education. Trade Stocks, ETFs, Options Or Futures online. Why trade stocks with E*TRADE from Morgan Stanley? · Pay $0 commissions for US-listed stock trades · Trade online and through our best-in-class E*TRADE Mobile app. TradeZero commission free stock trading software lets you trade and locate stocks from any device and includes real-time streaming and direct market access.